STAP is a specific subsidy intended to support working people to learn new skills so they can better perform at their job, or be trained to do something new.

A new application period opens every 3 months – meaning your next chance to apply is September 01, 2022. After March’s expectantly high demand for the subsidy, we decided to write this article so you can be well-prepared for the next application moment!

Who’s eligible for STAP?

The official description for people who can apply for STAP is relatively all-encompassing. In English, the Dutch government describes the STAP budget as “for all employees and job seekers who want to improve their chances on the labour market.” Anybody who can “demonstrate ties with the Dutch labour market” is eligible to apply.

Here are a few examples of demonstrable ties to the Dutch market –

- Currently employed at a Dutch company

- You work and live in the Netherlands

- You are receiving unemployment or sickness benefits

If any of the above examples apply to you, you are eligible for the STAP budget if –

- You are over 18 years of age, but below pension age (66)

- You are not retired and do not receive old age pension (AOW)

- You or your partner have an EU nationality

- You had Dutch insurance for at least 6 months out of the last two years

- You do not receive any other form of an educational grant (such as studiefinanciering)

How to apply for STAP?

Before you start your application for STAP, you need to prepare two things: Your DigiD and a STAP registration certificate (STAP-aanmeldingsbewijs) from the training course you intend to follow. This certificate is essential to apply for the subsidy successfully – make sure you receive it from the trainer before you begin the process.

To begin your application, you’ll need to visit the official website for STAP (in Dutch) and log in with your DigiD here: https://www.stapuwv.nl/stap/login

Once you’ve logged in, click the button “vraag STAP-budget aan” to launch the application process.

In order to complete your application, you will need to provide information about the training course you intend to follow, as well as your current employment situation. The UWV will review your application and transfer the money to the trainer – as long as there is still leftover budget for the period.

As we learned from the last application window, it’s important to apply early in order to improve your chances of receiving the subsidy. The next application period starts September 01 at 10:00 CET.

How much can I claim?

STAP covers the cost of a training course up to 1000 euros. Any costs above 1000 euros will need to be paid by yourself. Fortunately, your employer can also supplement the fee of your training – because these costs are tax-deductible for businesses.

The Dutch Chamber of Commerce (KvK) published a letter in English to employers about using the STAP budget to motivate their employees. You can read this letter on the KVK website here.

What kind of training can I take with STAP?

Many training organisations who are registered with STAP are advertising themselves as such – so it’s worth it to check in our any training courses you’ve had your eye on!

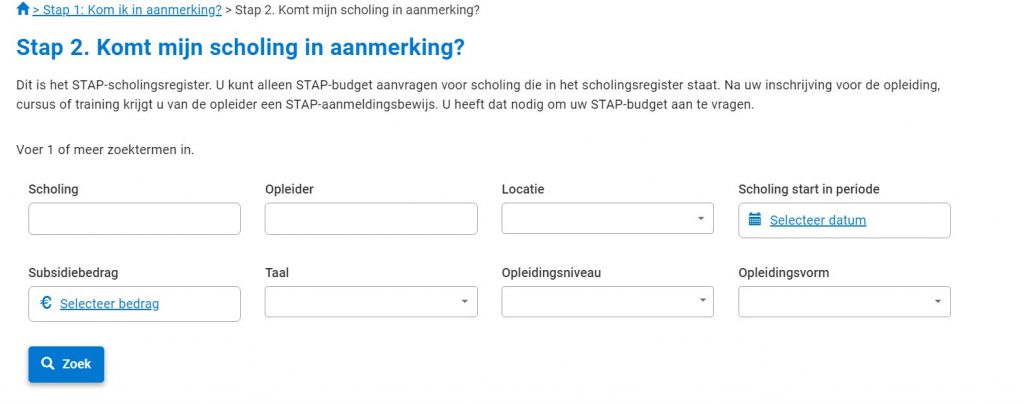

If you don’t know how to start – Check out the online training registry (in Dutch) online here. The first pop-up you see will ask your age (some courses are only available to certain ages) before you are taken to the page below.

You can search by language (Taal) or the next start period (Scholing start in periode) to get a complete list of all the training courses registered under STAP. Click “zoek” to generate the list once you have completed the fields.

5 winter activities in the Netherlands you can’t miss!

13-12-23

The winter season is always filled of joy and that “gezellig” feeling that surrounds the festivities. However, it is still difficult to come up with activities to spend quality time with family and friends at this time of year. The ...

Dutch health insurance 101: a beginner’s guide

08-12-23

Are you planning to come to the Netherlands for work? Everyone who lives or works in the Netherlands is required by law to take out Dutch health insurance. A standard health insurance package is compulsory covering consultation with a GP, hospital treatment, and prescription, while an additional package such as for dental check-ups is optional.

Submission to Octagon: personal reflection on learning Dutch to live in the Netherlands

29-11-23

We at Octagon Professionals are made up of a team of expats and internationals from all over the world. So many members of our team have first-hand experience about what it’s like to be an expat and live in a ...

Debunking 5 myths about visas in the Netherlands (2.0)

15-11-23

For this edition of debunking Visas myths, we bring you 5 common myths around visas and permits to live and work in the Netherlands. 1. “I can relocate my non-European workers to the Netherlands without extra steps.“ It is not ...

General tips on the absenteeism interview or long-term sick leave check-in

02-11-23

First things first. As an employer you have a duty of care to your employees. Most companies feel this duty very acutely; however, it is not easy to put it into practice. Here are 10 tips on making the absenteeism ...

How to have a health check-in or absenteeism interview

24-10-23

Communicating effectively with an employee who is on sick leave is crucial to ensure a smooth and legally compliant process under Dutch labor law. It’s important to show empathy, maintain open lines of communication, and adhere to regulations. We want ...

Retention as talent acquisition strategy – an Employer’s Guide

12-10-23

Prevention is better than cure, and preserving is better than hiring. It is much more attractive for a company to retain an employee who already knows the organization, is satisfied, and knows that there are career opportunities than to look ...

Embracing diversity: mitigating BIAS at work

03-10-23

Our Participation on BIAS project, hosted by Leiden University – Proudly funded by EU. In today’s rapidly evolving business landscape, companies are continually seeking innovative ways to gain a competitive edge. One of the most profound strategies for achieving this ...