Wages in the Netherlands can baffle internationals regarding how it is calculated or how much tax is deducted from the “gross amount”. Not to mention, the minimum wage, social premiums, and extra benefits typical in the Netherlands is unique. We see that people new to the Netherlands are often unaware of how it all works.

In this article, we give more information about the minimum wage and how salaries are typically structured, and discussed, in the Netherlands. Keep in mind that the minimum wage is evaluated (and often changed) every 6 months – in January and July.

Gross versus net income

It’s important to keep the difference between gross and net income straight. While the difference between gross and net is the same in the Netherlands as it is everywhere else in the world, when discussing income, employers in the Netherlands usually refer to the gross amount.

Gross (bruto) income is the total amount of your salary before tax and other costs are deducted.

Net (netto) salary is your take home pay after income tax, social security payments and your the company pension has been deducted. The employer will take into account any benefits they can calculate on your behalf, such as 30% ruling tax for highly skilled migrants. Many of the benefits and/or premiums the employee receives generally have a specific tax rate that will need to be applied.

Minimum wages in the Netherlands in 2024

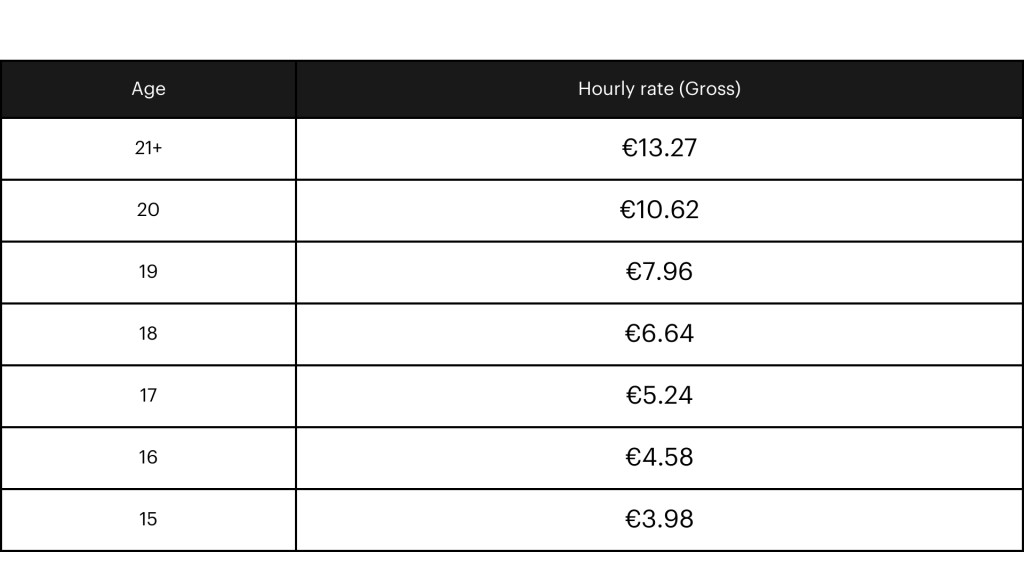

In the Netherlands, the minimum wage is variable depending on the age of the worker. However, the minimum wage peaks at age 21.

By law, everyone working in the Netherlands between the ages of 15 and stated pension age is entitled to be paid (at minimum) the Dutch minimum wage and a holiday allowance. The only exceptions to this law are internships or apprenticeships.

Until 2023 there were specific amounts for a minimum rate per hour; day; week and month. On the 1st of January 2024 this regulation has been modified. From now on there is only a minimum hourly rate. It is up to each employer to use this rate to calculate the monthly amount based on the (weekly) contracted hours.

Below is the table of the minimum hourly wages in the Netherlands at each age.

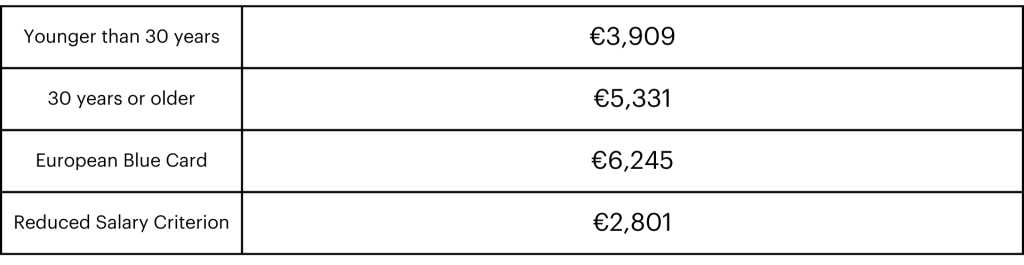

Minimum income requirements for expat employees in the Netherlands in 2024

In terms of income requirements for international workers on highly-skilled migrants visa, a certain salary criterion for their minimum wage is applied.

*Note: The above gross salary criteria excludes holiday allowance

Reduced salary criterion

In order to hire from abroad, the above salary criterion is usually required. However, there are 3 situations where employers could apply a reduced salary criteria when hiring a non-Dutch or EU person to work in the Netherlands:

1: The residence permit for employment as a highly skilled worker is applied to either during or directly following the orientation year for highly educated persons.

2: The highly skilled worker is no longer holding a residence permit for the orientation year for highly educated persons, but previously held this permit. The residence permit for employment as a highly skilled worker is applied for within 3 years of the graduation date, the date in which the doctorate was awarded, or the date in which the residence permit for scientific research expired.

3: The highly skilled worker has never had a residence permit for the orientation year for highly educated persons, but does meet the conditions for this residence purpose. For example, because the highly skilled worker has graduated, has a PhD or conducted scientific research. The residence permit for employment as a highly skilled worker is applied for within 3 years of the graduation date, the date in which the doctorate was awarded, or the date in which the residence permit for scientific research expired.

You could read more information about the orientation year visa on our blog, or read the official source from the IND here.

Set up your pay structure with Octagon Professionals

With over 30 years of experience working in employment in the Netherlands – our team of HR and employment experts can help your international company set up a pay structure aligned with Dutch market standards, and compliant with Dutch regulations.

Send us a message today and one of our experts will reach out to schedule a consultation with you.

more news

King’s Day: what you need to know

22-04-25

Spring has sprung, and the traditional Dutch holiday of ‘King’s Day’ is approaching! King’s Day is April 26th this year. If you don’t know what you should be doing to make the most out of this holiday, then you are ...

The role of HR in supporting neurodiversity in the workplace

16-04-25

In the spirit of Autism awareness month, it is important to bring awareness to the neurodiverse person in the workplace. After all, the workplace as it is today was built for the neurotypical in mind, putting neurodiverse people at a ...